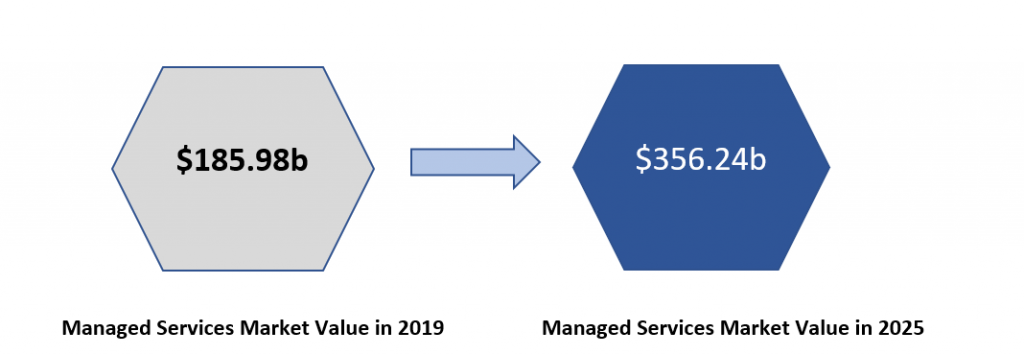

ST. PETERSBURG, Fla., February 08, 2022 (GLOBE NEWSWIRE) – The Methodical Group, a national information technology consulting firm, recently named Rene Head as vice president of its Operational Services Division. . The Methodical team strives to transform customer experience, business success, and efficiency through operational excellence. The Managed Services Division provides flexible solutions for the specific needs of the industry and operates within six key areas: policy and communication, technology and engineering, human resources, cybersecurity, data and intelligence artificial, and IT-managed services.

Head is a long-term business and technology product leader with more than 30 years of experience successfully helping consumers make money through cutting-edge technology and implementing new digital business processes. Most recently he was vice president of IT business and cloud services for Mindtree. He has held senior positions at Quest Software, Dell, Cognizant Technology Solutions, Unisys, and Hewlett Packard, among others. He obtained a bachelor’s degree in computer science from the University of Texas A&M.

The newly formed Managed Services Division will operate across a wide range of industries but focuses on national companies looking for growth in health, health, medical, banking and finance.

“Rene Head brings a wonderful experience and reputation for being a leader and thought leader in The Methodical Group,” said company president Josh Morris.

The Methodical Group is headquartered in St. Petersburg, Florida, but its staff and key contractors operate far and wide. The company represents mid- and regional-level companies as well as many members of the Fortune 500, including some of the most well-known forms of healthcare in the United States. For more information, visit MethodicalGroup.com.

Contact: PR Managermedia@methodicalgroup.com

This information is provided through an advertising service on Newswire.com.

Who owns CVS drug stores?

Are CVS and Walgreens the same company? No, CVS and Walgreens do not have the same owners. This may interest you : Staffing and Managed Services Are ‘Very Different’ Businesses. Why Are They Coming Together? | Legaltech News. CVS Health owns CVS while Walgreens is owned by the Walgreens Boots Alliance.

Who owns the most CVS stock?

| Ra-stockholder | Stake | The parts that belong to them |

|---|---|---|

| Vanguard Group, Inc. Property | 7.79% | 102,785,404 |

| BlackRock Fund Advisers | 4.41% | 58,192,303 |

| SSgA Funds Management, Inc. | 4.18% | 55,250,146 |

| Capital Research & Management Co …. | 3.83% | 50,573,988 |

Who are the stakeholders of CVS?

Employees, buyers and sellers, retailers and retailers, investors and the local community, are stakeholders involved in and close to CVS Health. This may interest you : Managed IT Services Market Current Analysis, Estimated Forecast to 2027 – IBM Corporation, Microsoft Corporation, Hewlett Packard Enterprise, Siemens Corporation, Alcatel Lucent, Cisco Systems Inc., etc – Industrial IT. CVS Health believes that staying close to including those involved in their CSR strategy, will help them succeed.

How many shareholders does CVS have?

About 200,421 people own standard CVS Health equipment and approximately 2,508 facilities own our property.

Is CVS owned by Aetna?

CVS completes acquisition of Aetna. See the article : Updated cyber security regulations proposed for managed services sector.

Why did CVS Health buy Aetna?

The joint venture will connect customers with strong CVS Health health facilities in communities across the country and Aetna’s network of providers to help remove barriers to high quality care and construction lasting relationships with customers, enabling customers to access information, resources. …

How are CVS and Aetna connected?

This plan integrates the Aetna Open Access Aetna Selectâ € network with extended access to CVS Pharmacy®. … Along with the simple and connected experience of members, middle-class businesses will see savings by integrating the Aetna Connected Plan with our national network.

What company owns Boots?

We aim to provide our customers with innovative products such as our No7, Boots Brand Healthcare, Boots Soltan, Botanics, YourGoodSkin, Sleek MakeUP and Soap & Glory, as well as special ‘In’ Boots’ products including Smashbox and Champneys.

What types of Walgreens? The department of retail and commercial companies includes Walgreens, Duane Reade, Boots, as well as global health and fitness products, including No7, NICE !, Soap & Glory, Liz Earle, Finest Nutrition, Botanics, Well Beginnings, Sleek MakeUP and YourGoodSkin.

Who are Boots owned by?

| In the past | Shoes Chemicals Talks Clean Drug Company Boots Money Chemistry |

|---|---|

| Number of employees | 56,000 (UK) 1,900 (Ireland) |

| Parent | Walgreens Boots Alliance |

| Low support | Boots Opticians |

| Website | www.boots.com |

Is Boots owned by an American company?

Boots UK Limited (formerly Boots the Chemists), sold as Boots, is a British health and beauty retailer and herbal chain in the United Kingdom and other countries and territories including Ireland, Italy, Norway , Netherlands, Thailand and Indonesia.

Is Boots owned by Walmart?

Carrots are the latest in a long list of well-known British brands to be sold to foreign companies. US Walmart Supermarket has taken over Asda in 1999, while Cadbury has been the American Kraft factory since 2010. … He and KKR’s independent financial firm have been business owners since 2007.

Is Boots owned by Walmart?

Carrots are the latest in a long list of well-known British brands to be sold to foreign companies. US Walmart Supermarket has taken over Asda in 1999, while Cadbury has been the American Kraft factory since 2010. … He and KKR’s independent financial firm have been business owners since 2007.

What Walmart Boots Alliance?

Walgreens Boots Alliance (WBA) is a Reliable, Global Designer at Retail Pharmacy. The purpose of the WBA is to create an even better life with good health. The purpose of the WBA is to create an even better life with good health.

Who has bought Alliance Healthcare?

CONSHOHOCKEN, PA, JUNE 2, 2021 – AmerisourceBergen Corporation (NYSE: ABC) today announced its completion to acquire several Walgreens Boots Alliance’s Alliance Healthcare businesses for as much as $ 6.275 billion in cash, compared to cash. standard operating and debt repair, with 2 million shares of …

Who is Alliance Healthcare?

Has Alliance Healthcare been sold?

CONSHOHOCKEN, PA, JUNE 2, 2021 â € ”AmerisourceBergen Corporation (NYSE: ABC) today announced the completion of its acquisition of most of the Walgreens Boots Alliance Alliance’s Alliance Healthcare for a total of $ 6.275 billion, based on normal working and full credit. repair, and 2 million shares of …

Who bought Alliance Healthcare?

In June 2021 AmerisourceBergen acquired the Alliance for about $ 6.275 billion.

Did Walgreens buy AmerisourceBergen?

Major drug dealer AmerisourceBergen has completed the acquisition of Walgreens Boots Alliance’s “Alliance Healthcare” large $ 6.5 billion business, the companies announced Wednesday.

Who bought Alliance Imaging?

(â € œAllianceâ €), the country’s leading provider of radiology and oncology solutions to hospitals, health services and medical teams, announced today that it has entered into an agreement worth $ 820 million by Akumin Inc.

Who owns Alliance mri?

The Alliance is owned by Tahoe Investment Group, a Chinese financial firm, which acquired a healthcare company for $ 178 million through two separate transactions in 2016 and 2017.

Is Alliance Health owned by China?

Alliance Healthcare Services Inc., a provider of Irvine-based radiology centers, may be sold by its owner, Tahoe Investment Group Co. of China, according to Bloomberg News. … The Alliance, with 2,500 employees, operates more than 600 radiation diagnostics, radiation therapy and radiation intervention methods.

What makes cross border alliances an attractive strategic alternative?

Reasons why companies use cross-border schemes: These types of agreements are relatively harmless compared to mergers or acquisitions. This type of partnership helps the company gain competitive advantage in a foreign market, creating a geographical divide.

What is Cross border Strategic alliance? A cross-border strategic alliance is an agreement between two or more trade associations from two different countries to pursue similar interests (e.g., Ariño, 2002, Gulati, 1995, Kale et al., 2002) .

What would be the key factors for determining the success of this cross border alliance?

The following sections examine some of the key issues affecting policy treaties.

- 1.1. Same goal. …

- 1.2. Work problems. …

- 1.3. Join the covenant with the covenant scale. …

- 1.4. Communication and cooperation. …

- 1.5. Business transformation and strategy. …

- 2.1. A common cultural practice. …

- 2.2. …

- 2.3.

What is a cross border alliance?

Cross-border agreements can be defined as partnerships based on two or more factories from different countries with the aim of pursuing their interests by sharing their resources and capabilities (Doz & Hamel, 1998; Yan & Luo, 2001).

What makes strategic alliances successful?

Successful alliances are based on the ability of both parties to work in the same company. For this type of collaboration to happen, team members need to know how their partners work: how to make decisions, how to distribute resources, how to share information.

What makes a good strategic partnership?

What makes co-operation a strategy? With strategic partnerships partners remain independent; share the benefits of, risks and control over joint actions; and to provide continuous contributions to policy areas.

Are strategic alliances successful?

Despite their popularity, 60 to 70 percent of treaties fail, according to Jonathan Hughes and Jeff Weiss. Many relationships do not fail completely but suffer along the way, never realizing the expected benefits. Very few companies establish partnerships consistently and achieve their business goals.

Why strategic alliances are important?

alliances help access global markets. … However, through strategic partnerships, companies can improve their competitive environment, gain access to new markets, contribute valuable skills, and share risk and cost-effectiveness. development improvements.

How important is strategic alliance?

Strategic partnerships allow partners to grow faster, build new solutions for their clients, enter new markets, and integrate valuable experience and resources. And, in a business environment that appreciates speed and creativity, this is a game changer. Loss of control.

Is Walgreens a good dividend stock?

Walgreens Boots Alliance Inc (Token: WBA) has created the & quot; Dividend Channel S.A.F.E. … Tolerant – at least twenty years of share payments. The highest dividend share paid by Walgreens Boots Alliance Inc is $ 1.91 / in total, paying dividends per quarter, and the initial amount was 08/19/2021.

How often does Walgreens Stock pay dividends? The Walgreens Boots Alliance has paid quarterly dividends since 1933 and has increased from $ 1.53 / split in 2017 to $ 1.88 / split in 2021. The current quarterly share, if given annually, yielding a 4.1% harvest.

Is Walgreens a dividend king?

The Walgreens Boots Alliance (WBA) division has been a regular payment since 1972 and has increased for 46 consecutive years; the company qualifies as an Aristocrat Separation Division and Divisional Champion.

Is Walgreen boots alliance a good stock to buy?

Walgreens Boots Alliance, Inc. it may be minimized. The Value Score of A shows that it can be a good choice for quality investors. WBA’s financial health prospects and WBA growth, show its potential beyond the market. It currently has a Growth Score of B.

Is Walgreen a good stock?

Walgreens Stock Basic Analysis To determine whether WBA stock is a current commodity, a basic and technical analysis is essential. The IBD Stock Checkup tool shows that WBA stock has an IBD Composite Rating of 80 out of 99 possible.

Does Walgreens pay a dividend?

The Walgreens Boots Alliance has given an average of 11% annual annual increase in its distribution, based on the past 10 years of share payments. It is interesting, but the combination of rising and low wages can only be achieved by paying a higher percentage of profits.

Is Walgreens a good dividend stock?

Walgreens Boots Alliance Inc. (Brand: WBA) has made “Dividend Channel SAFE … Enduring – at least twenty years’ . and the old date of its separation was 08/19/2021.

When did Walgreens pay dividends?

(Nasdaq: WBA) today announced that its board of directors announced a quarterly dividend of 47.75 cents per share, unchanged from the previous quarter and an increase of 2.1 percent from the previous quarter. Assignment paid Dec. 10, 2021, to right holders from Nov.

Is Walgreens stock a good investment?

The highest return on Walgreens Corporation shares was 3.9%. This harvest â € ”along with the low pay rate and potential increase in profits â €” should attract money-hungry investors at the time of retirement or on the verge of retirement. That is the return of three S&P 500’s paltry 1.3%.

Is Walgreen a good stock?

Walgreens Stock Basic Analysis To determine whether WBA stock is a current commodity, a basic and technical analysis is essential. The IBD Stock Checkup tool shows that WBA stock has an IBD Composite Rating of 80 out of 99 possible.

Will Walgreen stock go up?

Forecast Stock Price The 18 analysts who provide a 12-month price estimate for Walgreens Boots Alliance Inc have a median target of 53.00, with a high rating of 70.00 and a low estimate of 45.00. The median estimate represents an increase of 9.08% from the last price of 48.59.

Is WBA a good dividend stock?

The price of Walgreens products is much higher than the S & P; average 500. Walgreens Boots Alliance, MSC Industrial Direct, and Ames National each found the product as stock to consider for of a secure portfolio of divisions, providing some reliable shortcomings. low yield.

Is WBA the king of finance? The Walgreens Boots Alliance (WBA) division has been a regular payment since 1972 and has increased for 46 consecutive years; the company qualifies as an Aristocrat Separation Division and Divisional Champion.

Is WBA a dividend aristocrat?

(NASDAQ: WBA) … (NASDAQ: WBA), a drug retailer, operates through its subsidiaries of Retail Pharmacy USA, Retail Pharmacy International, and Pharmaceutical Wholesale. The company provides health and wellness products and ranks 10th in our list of the best dividend aristocrats with more than 4% products.

Is WBA dividend safe?

The price of Walgreens products is much higher than the S&P 500 average. Walgreens Boots Alliance, MSC Industrial Direct, and Ames National each found the product as a stock to consider for a secure division portfolio. , eliminating those who pay for honest dividends that offer lower yields. .

Who are the dividend aristocrats in 2021?

Here are three of the newest aristocrats:

- IBM. …

- NextEra Energy. …

- Western Medical Services. …

- Carrier Global Corp. …

- Otis International Association …

- Raytheon Technologies Corp. …

- Special issue: AT&T.

Is WBA a good stock to buy now?

WBA Stock: Is It a Purchase? Important Note: In technical terms, WBA stock is currently in stock. It is within 5% of the 52.03 point of sale, which is 10 cents above its initial September high.

Is Walgreens Boots Alliance stock a buy?

The Walgreens Boots Alliance has obtained Hold points. The total score for the company is 2.00, and it is based on 1 price point, 9 holding points, and 1 sales point.

Is Walgreens a good stock to own?

Best Stocks 2021: Walgreens Boots Alliance is still a Buyable Price. … WBA is also one of our Best Stocks for the 2021 recommendations. WBA stock has generated a total profit of 20.7% so far. This is well ahead of the SPDR S&P 500 ETF (NYSEARCA: SPY), which has returned 17.3% so far this year.

Does WBA pay a dividend?

The WBA trading rate is $ 1.89 in total. The annual share of the WBA was 3.85%. The Walgreens Boots Alliance’s share price is lower than the US Pharmaceutical Retailer industry average of 4.31%, and below the US market share of 4.48%.

How long has WBA paid a dividend?

Walgreens Boots Alliance and its predecessor, Walgreen Co., paid dividends on 356 straight shares (89 years) and increased profits for 46 consecutive years.

Does WBA stock pay a dividend?

The WBA trading rate is $ 1.89 in total. The annual share of the WBA was 3.71%.